The Critical Difference Between Growth and Profitable Growth

Profitable revenue growth is the simultaneous achievement of increasing sales and maintaining or improving profit margins—expanding your business without sacrificing profitability. It’s not just about getting bigger; it’s about getting better.

Here’s what you need to know about profitable revenue growth:

- It’s harder than it sounds – Only one in eight companies achieve more than 10% annual revenue growth, and profitable growth is even rarer

- It requires strategy – You need to optimize across multiple areas: pricing, marketing, operations, and customer value

- The math compounds – Improving multiple growth levers by just 10% each can increase velocity by 49% or more

- Measurement matters – Track metrics like Customer Lifetime Value (CLV), Customer Acquisition Cost (CAC), gross profit margin, and ROI

- It beats the alternative – Growth without profitability leads to cash flow problems, investor skepticism, and unsustainable business models

Most executives wake up wanting to grow their companies. It’s more exciting than running a business for efficiency. But here’s the hard truth: many businesses plan for growth without focusing on profitability. They chase sales without considering margins, or build infrastructure for revenue that never materializes.

The result? Top-line revenue increases while bottom-line profits shrink or disappear entirely.

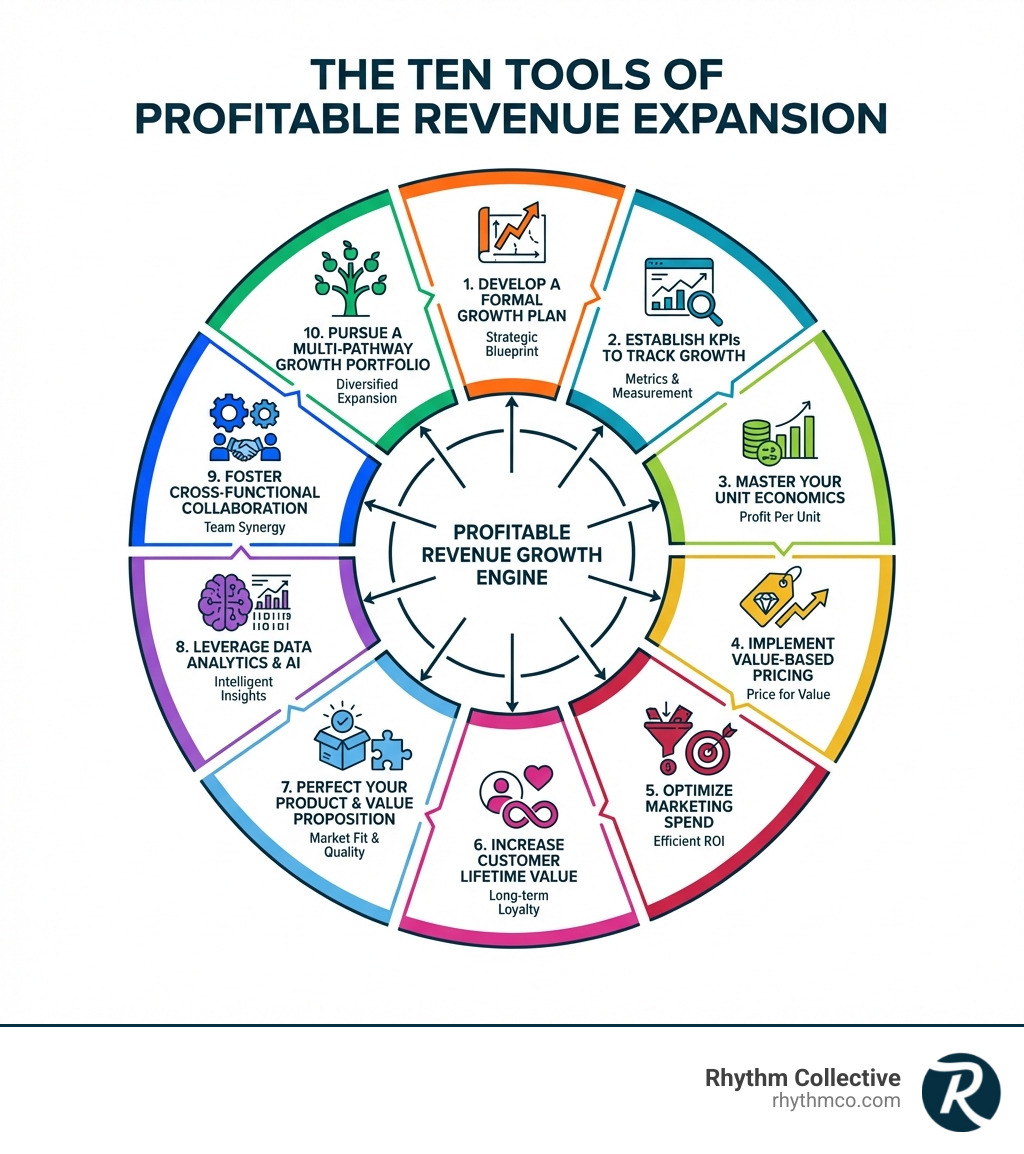

This guide presents ten practical tools to help you achieve what matters most: growth that actually strengthens your business. These aren’t theoretical concepts—they’re proven strategies used by companies that outperform their peers by 97% when implemented across multiple growth pathways.

Whether you’re a startup building brand equity or an established company seeking to scale, the principles remain the same. Profit and cash generation aren’t just nice-to-haves. They’re essential parts of your financial strategy, providing the fuel to reinvest and grow.

The Strategic Foundation: Planning and Measurement (Tools 1-3)

Achieving profitable revenue growth isn’t about hoping for the best; it’s about meticulous planning and precise measurement. Just as a builder needs a blueprint and a tape measure, your business needs a clear strategic roadmap and the right tools to track progress. This foundational stage involves defining your goals, understanding what success looks like, and knowing the core financial mechanics of your operations. Balancing growth and profitability means making deliberate choices grounded in data, not guesswork.

Tool 1: Develop a Formal Growth Plan

“Hoping for growth is not a strategy.” We couldn’t agree more. A formal growth plan is your business’s North Star, guiding every decision toward profitable revenue growth. This isn’t just a wish list; it’s a thorough, well-crafted blueprint that defines your business objectives, identifies your competitive advantage, and ensures scalability and sustainability.

Your plan should outline how you’ll maximize the value of your core business, explore adjacent opportunities, and even venture into new business lines. For instance, CRAFTD London built its sustainable growth strategy on three key pillars: being profitable from day one, sticking to a lean, results-driven team, and prioritizing work-life balance. These aren’t just values; they’re strategic choices embedded in their plan. A well-defined plan helps you allocate resources effectively, optimize marketing spend, and focus on offerings that truly resonate with customers. If you need help crafting this essential roadmap, our Marketing Consulting Services can provide the expert guidance you need.

Tool 2: Establish KPIs to Track Profitable Revenue Growth

You can’t manage what you don’t measure, and this is especially true for profitable revenue growth. Key Performance Indicators (KPIs) are your business’s vital signs, telling you whether you’re on the right track. Simply growing revenue isn’t enough; you need to ensure that growth is profitable.

Our core KPIs include:

- Profit Margin & Gross Margin: These ratios tell you how much profit you’re making relative to sales, indicating the health of your pricing and cost structure.

- Return on Investment (ROI): Crucial for evaluating the effectiveness of your marketing campaigns and other investments. Are your efforts yielding more than they cost?

- Customer Acquisition Cost (CAC): The total cost to acquire a new customer. Keeping this low is vital for profitability.

- Customer Lifetime Value (CLV): The projected revenue a customer will generate over their relationship with your business. A high CLV compared to CAC is the holy grail of profitable growth.

We’ve seen that companies tracking velocity weekly achieve 3x higher growth rates (34% vs. 11%) compared to those who review quarterly. This consistent monitoring leads to 87% forecast accuracy, allowing for proactive adjustments rather than reactive damage control.

Tool 3: Master Your Unit Economics

Understanding your unit economics means knowing the costs and revenues associated with each product or service you sell. It’s the granular detail that underpins profitable revenue growth. This involves dissecting your financial reports to generate useful insights.

Key elements include:

- Break-even Point: The sales volume at which total costs and total revenues are equal. Knowing this helps you set realistic sales targets.

- Cost of Goods Sold (COGS): The direct costs attributable to the production of goods or services.

- Operating Expenses (OPEX): The costs associated with running your business, not directly related to production.

By calculating your break-even points and markups, you can set competitive prices that ensure profitability. Profit and cash generation are not merely accounting terms; they are essential parts of your financial strategy, providing the capital needed to reinvest and fuel further expansion. Ignoring these fundamentals is like trying to drive a car without knowing how much gas is in the tank – you’re bound to run out.

The Core Levers: Optimizing Price, Promotion, and Product (Tools 4-7)

Once your strategic foundation is solid, it’s time to pull the core levers that directly influence your sales and profitability. These are your daily operational tools for driving profitable revenue growth: how you price your offerings, how you promote them, and the quality of what you sell. Effective Revenue Growth Management (RGM) in areas like East Tennessee, means constantly optimizing these elements to deliver maximum customer value while maintaining healthy margins.

Tool 4: Implement a Value-Based Pricing Strategy

Pricing is an art and a science, and a value-based strategy is crucial for profitable revenue growth. This means setting prices not just based on your costs, but on the perceived value your product or service offers to the customer. We analyze factors like price elasticity (how demand changes with price), customer segmentation (tailoring prices to different customer groups), and competitor benchmarking.

Consider implementing dynamic pricing, tiered pricing, or bundling strategies. For example, pet goods retailer Wild One bundles related items—like a leash, harness, and waste bag carrier—to encourage customers to buy everything they need in one purchase, significantly increasing their Average Order Value (AOV). Our goal is to capture greater value from every sale, ensuring your prices reflect the quality and benefits you provide.

Tool 5: Optimize Marketing Spend for Profitable Revenue Growth

Marketing is an investment, not just an expense. But to drive profitable revenue growth, that investment must be optimized for maximum ROI. We’ve seen that only 22% of companies can measure their trade spending at the individual event level, which means a lot of marketing dollars are spent without clear accountability.

The US Small Business Administration suggests small businesses (under 250 employees) typically spend 7% to 8% of their total revenue on marketing, while larger companies might spend 10% to 14%. If you have significant online sales (over 10% of total revenue), that figure might climb to 13%. We advocate for a rigorous analysis of past marketing budgets, focusing on the effectiveness of each line item. Whether it’s Search Engine Marketing or Social Media Marketing, every dollar spent should be tied to measurable outcomes. It’s about finding that “individual tipping point” where your marketing efforts yield the highest return, ensuring your promotional efforts contribute directly to your bottom line.

Tool 6: Increase Customer Lifetime Value (CLV)

Acquiring new customers can be expensive, so nurturing your existing ones is a direct path to profitable revenue growth. Customer retention is often more cost-effective than acquisition. By increasing Customer Lifetime Value (CLV), you build a loyal base that not only makes repeat purchases but also becomes your brand ambassador.

Strategies include:

- Loyalty Programs: Spice brand Fly By Jing runs an annual loyalty program offering free shipping and discounts, turning customers into advocates.

- Referral Programs: Polysleep, a mattress company, successfully reduced CAC and increased CLV by sending gift cards to customers who referred friends.

- Exceptional Customer Experience: An omnichannel approach, whether online or in person, makes customers feel valued. Bra brand LIVELY invested in experiential retail with in-person fittings, which proved more cost-effective than online conversion.

By fostering authentic connections and providing outstanding service, you create customers for life, ensuring a steady stream of predictable, profitable revenue.

Tool 7: Perfect Your Product and Value Proposition

At the heart of any successful business lies a product or service that truly solves a customer’s problem. To achieve profitable revenue growth, you must continuously perfect your offering and ensure your value proposition is crystal clear. As one CEO put it, “Your job is to make something sustainable and interesting for a consumer. Start with a product that you’d actually want to consume.”

This means:

- Listening to Customer Feedback: Use it to iterate and improve. Aloha, a protein brand, saw a 289% increase in sales after exiting unprofitable categories and refining their product based on what customers valued.

- Unique Value Proposition: What makes you different and better? This competitive advantage allows you to charge premium prices and attract dedicated customers.

- Upselling and Cross-selling: Once you have a great product, strategically offer complementary items or upgrades.

Investing in your product’s quality and ensuring its relevance is a direct investment in your long-term profitability. A strong product, coupled with consistent graphic design that communicates its value, creates an undeniable appeal.

The Advanced Playbook for Sustainable Profitable Revenue Growth (Tools 8-10)

In today’s dynamic market, achieving profitable revenue growth requires more than just solid fundamentals; it demands an advanced playbook. This means embracing innovation, making data-driven decisions, and fostering a collaborative environment that can adapt to rapid changes. We’re talking about long-term sustainability, ensuring your growth isn’t just a fleeting success but a lasting legacy.

Tool 8: Leverage Data Analytics and AI

Data is the new oil, and AI is the refinery that turns it into fuel for profitable revenue growth. By leveraging data analytics and AI, businesses can move beyond guesswork to precision. AI and Machine Learning (ML) can remove human bias from demand forecasting, identifying complex patterns and seasonality for more accurate predictions. This prevents costly inventory issues and ensures you’re always ready for customer demand.

AI can also simulate different market scenarios, helping you assess risks and optimize pricing strategies. Econometric models reveal how sensitive your revenue is to external factors like GDP or consumer spending, while Monte Carlo simulations can predict the probability of various revenue outcomes. For your online presence, this translates into advanced personalization at scale, delivering custom experiences that boost conversions. And with tools like Expert Website Management for Business Growth, you ensure your digital storefront is always optimized to capture and convert these insights into revenue.

Tool 9: Foster Cross-Functional Collaboration

Silos are the silent killers of profitable revenue growth. When departments operate independently, opportunities are missed, and inefficiencies abound. Cross-functional collaboration is about breaking down these barriers, creating shared goals, and ensuring everyone is pulling in the same direction.

For instance, in Revenue Growth Management (RGM), if the sales team runs a promotion without informing supply chain, you could face stockouts and lost sales. Effective collaboration means:

- Shared KPIs: Everyone works towards the same profitability-driven metrics.

- Centralized Tracking: A single source of truth for performance data.

- Regular Meetings: Consistent communication between sales, marketing, finance, and operations.

This alignment, sometimes called “Smarketing,” ensures that marketing efforts are not just generating leads but qualified leads that sales can efficiently convert into profitable customers. It’s about seamless execution, from strategy to customer delivery.

Tool 10: Pursue a Multi-Pathway Growth Portfolio

The most successful companies don’t put all their eggs in one basket. They pursue a multi-pathway growth portfolio, which makes them 97% more likely to outperform their peers. This strategy for profitable revenue growth involves three distinct pathways:

- Maximizing the Core: Optimize your existing products, services, and customer base. This is where about 80% of growth typically comes from. Fine-tune your sales team, optimize marketing spend, and focus on your highest-growth opportunities.

- Exploring Adjacencies: Look for opportunities to expand into related areas. If you’re a food manufacturer, could you produce a complementary product for the same aisle? If you operate in Knoxville, TN, could you expand into Maryville, TN, or Sevierville, TN? These are often lower-risk expansions.

- New Business Initiatives: This is where true innovation happens. These ventures carry higher risk but offer massive upside. Half of a company’s revenue in five years may come from areas they are not in today.

By making deliberate bets across these pathways in parallel, you build a resilient, adaptable business capable of long-term sustainable growth, even amidst economic shifts.

Frequently Asked Questions about Profitable Growth

How do you measure profitable growth?

We measure profitable revenue growth by tracking both your profit and your revenue growth rate simultaneously. The key is to ensure that your operating profits remain positive (or even increase) as your total revenue grows.

Here’s a simple way to think about it:

- Calculate Profit Growth Rate: (Current Period Profit – Previous Period Profit) / Previous Period Profit

- Calculate Revenue Growth Rate: (Current Period Revenue – Previous Period Revenue) / Previous Period Revenue

If your revenue is growing, but your profit is stagnant or declining, you have growth, but not profitable growth. We also look at metrics like gross profit margin, net profit margin, and return on investment (ROI) to get a comprehensive picture of your business’s financial health.

What are the biggest challenges to achieving it?

Achieving profitable revenue growth is no walk in the park. Some of the biggest problems we see businesses face include:

- Short-term Focus: Prioritizing quick revenue wins over long-term profitability.

- Departmental Silos: Lack of collaboration between sales, marketing, and finance, leading to misaligned efforts and inefficient spending. As one study found, 75% of Revenue Growth Management programs don’t generate positive profit growth for both retailer and manufacturer.

- Inaccurate Data & Measurement: Not being able to accurately track the ROI of marketing or promotional activities. Only 22% of companies can measure trade spending at the individual event level.

- Unprofitable Customers/Products: Chasing every sale or product line, even those that drain resources and offer low margins.

- External Factors: Market demand fluctuations, intense competition, and economic downturns can all make profitable growth challenging.

Overcoming these requires a deliberate strategy, robust data, and a willingness to adapt.

How much should a business spend on marketing for growth?

The ideal marketing spend for profitable revenue growth isn’t a one-size-fits-all number; it depends on several factors:

- Company Size: According to the U.S. Small Business Administration, small businesses (under 250 employees) typically spend 7% to 8% of their total revenue on marketing. Larger companies might aim for 10% to 14%.

- Company Age: Younger companies (1-5 years old) often need to invest more (12% to 20% of revenue) to build brand equity. Established brands can sometimes operate efficiently with 6% to 12%.

- Online Sales Percentage: Businesses with over 10% of sales from online channels tend to allocate more (around 13% of revenue) compared to those with less online presence (around 10%).

- Industry & Goals: Highly competitive industries or those launching new products might need higher budgets.

The key is to focus on the effectiveness of your marketing budget, ensuring every dollar contributes to a positive ROI. It’s about finding that “individual tipping point” where your investment yields the most profitable returns, not just spending for the sake of it.

Conclusion: Making “Good Growth” Your Rhythm

Achieving profitable revenue growth is the ultimate goal for any sustainable business. It’s the difference between merely existing and truly thriving. We’ve explored the ten essential tools that empower businesses to not just grow, but to grow smart—ensuring every increase in revenue strengthens your bottom line and builds long-term value.

Let’s recap our ten tools for expansion:

- Develop a Formal Growth Plan: Your strategic blueprint for success.

- Establish KPIs to Track Profitable Revenue Growth: Measure what truly matters.

- Master Your Unit Economics: Understand the financial heartbeat of your business.

- Implement a Value-Based Pricing Strategy: Price for profit and perceived value.

- Optimize Marketing Spend for Profitable Revenue Growth: Invest wisely, measure diligently.

- Increase Customer Lifetime Value (CLV): Nurture your most valuable assets.

- Perfect Your Product and Value Proposition: Deliver excellence that resonates.

- Leverage Data Analytics and AI: Turn insights into actionable growth.

- Foster Cross-Functional Collaboration: Break down silos, build bridges.

- Pursue a Multi-Pathway Growth Portfolio: Diversify your approach for resilience.

By embracing these tools, you’re not just chasing arbitrary numbers; you’re building a more robust, resilient, and valuable business. This commitment to “good growth” translates into increased investor confidence, greater flexibility for future investments, and a healthier, more sustainable enterprise overall.

Ready to make profitable revenue growth your business’s rhythm? We’re here to help you compose your success story. Contact Us today and take the next step toward sustainable success with a Digital Marketing Agency in Knoxville that focuses on what matters most—your bottom line.